Effective: 03/15/2021

Reversal vouchers are used to reverse a voucher that has been matched to a purchase order posted, and paid (i.e., the voucher must reference an incorrect purchase order). Reversal vouchers restore an encumbrance for budgets and reduce a purchase order's matched quantity or amount. Reversal vouchers are matched, approved, budget-checked, and threshold checked. They cancel out an unpaid voucher (see Unpaid Voucher Report below) by copying the original voucher with the signs reversed and unmatching the voucher with the purchase order or receipt to which it was originally matched.

Erroneous, duplicate, or illegal payments should be processed as refunds (revenue) and the supplier should provide the agency with a check (reversal vouchers should not be used in this scenario).

FSS-participating agencies will submit requests reversing OBM Financial Support Services (FSS) generated vouchers to FSS when the change needed impacts a purchase order. A reversal voucher request will not be approved to change the origin code or invoice number unless the agency is reporting on the field(s).

Reversal vouchers will be created EITHER by request from the agency or when discovered by FSS. When FSS discovers that a reversal voucher is needed - FSS will notify an agency when a reversal is to be completed. The notification should include the following:

The voucher number that is being reversed

The reason for the reversal

If a corrective voucher will be done

The FSS associate should send the email using the contact name(s) listed on the agency’s end state assessment.

AP Associate, CRM Team, Coach determines a reversal voucher is required.

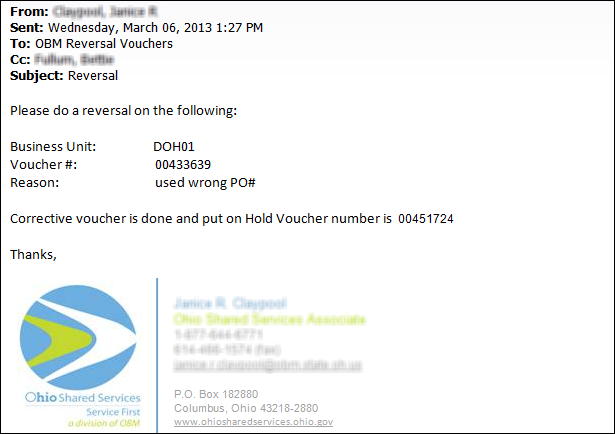

FSS emails a reversal voucher request to the OBM Reversal Vouchers mailbox. The email should contain the following information:

Business Unit

Original voucher number

Reason why a reversal is being requested

The email should include an agency contact. Including the agency on all email communications will keep them informed of what is occurring with the voucher/payment and will also provide helpful information if the agency has to communicate with the supplier.

If a corrective voucher is required, FSS should enter the voucher as soon as it is requested by OBM - State Accounting and reply back with the corrective voucher number.

Click "reply all" on all emails. The FSS participating agency should be on all email communication regarding reversal vouchers. FSS AP should ensure that this occurs as it is their responsibility to keep the agency (customer) informed regarding the invoice.

| Problem | Cause | Solution |

|

While creating a journal voucher a "No matching values were found" message displayed. |

Attempting to enter the related Voucher ID before the Supplier ID will produce the error message. |

Enter a Supplier ID before the Voucher ID when creating a journal voucher. |

|

While creating a journal voucher for Single Pay Suppliers – Related Voucher look up is blank. |

Journal Vouchers cannot be created for Single Pay Vouchers. |

Create a CRM case to request an update to Supplier ID and Voucher ID Related. |

|

Creating a corrective voucher to offset the reversal voucher displays an error saying "A duplicate invoice has been detected …" |

OAKS will not create a duplicate voucher. The system checks to see if the business unit, supplier ID, dollar amount, invoice number, and invoice date are the same as another voucher entered previously. | When creating a corrective voucher, use the same information as the original voucher except add a "CORR" to the end of the Invoice number, reference the correct purchase order and show the correct coding. |

Processing reversal vouchers will reverse a voucher that has been matched to a purchase order and posted in order to cancel out an unpaid voucher. If the original voucher has already been paid, the requesting agency will need to enter a corrective voucher with the correct coding information and temporarily place that voucher on hold. Creating a corrective voucher will offset the reversal voucher. If a Corrective Voucher is required, FSS should enter the voucher as soon as it is requested by OBM - State Accounting and reply back to the requesting email with the Corrective Voucher number.

OAKS FIN will not duplicate vouchers. The corrective voucher must maintain the business unit, supplier, dollar amount, and invoice date from the original voucher. To delineate the corrective voucher from the original, best practice is to maintain the original invoice number and add a "hyphen CORR" to the end, (Example: 12345-CORR). The corrective voucher, like the reversal, must indicate:

Hold Payment check box selected and a Reason Code of "ACC"

Payment Terms marked "Due Now"

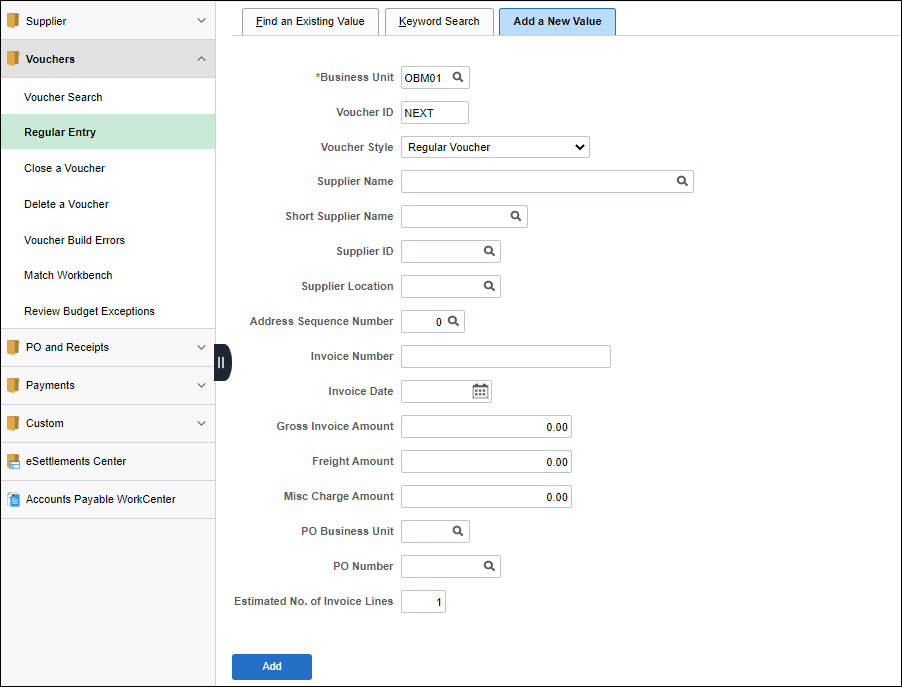

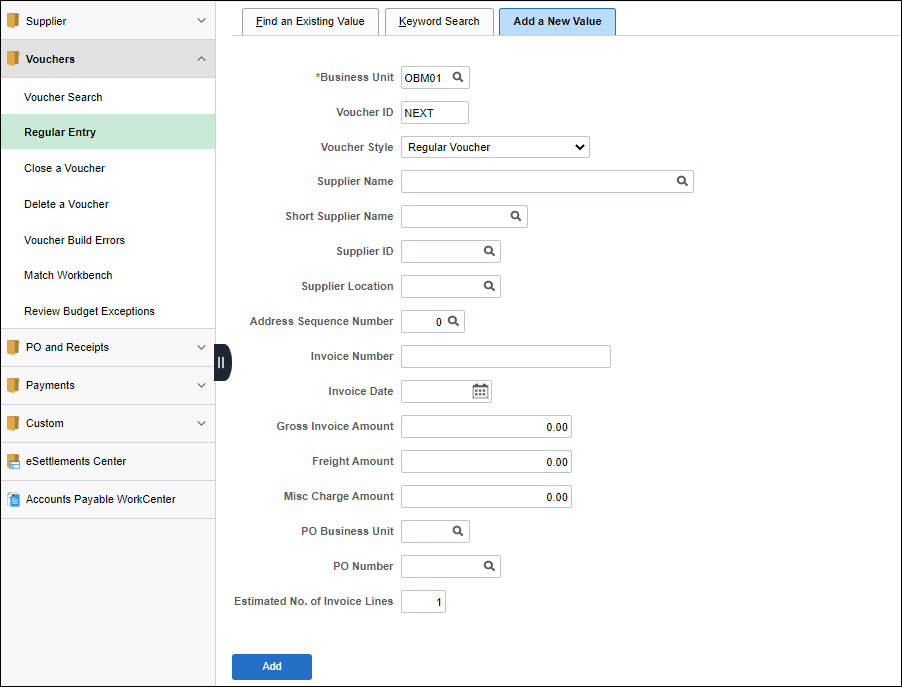

Enter the Business Unit of the purchasing agency.

The Business Unit defaults to "OBM01" for FSS voucher processing.

The Voucher ID field defaults to "NEXT." Do not change. OAKS FIN automatically assigns the next available Voucher ID code.

The Voucher Style field defaults to "Regular Voucher." Do not change.

Click Add.

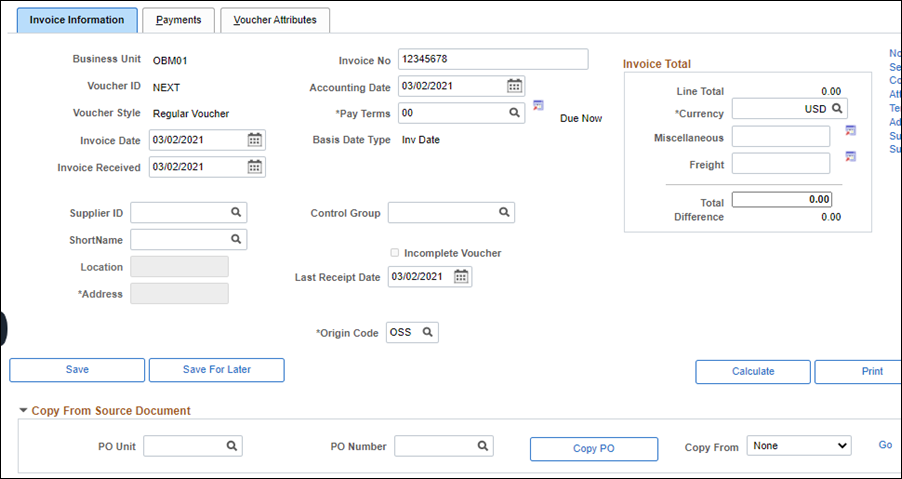

Invoice Information tab displays.

Enter Invoice Number.

Enter Invoice Date.

Enter Invoice Received date.

Enter Last Receipt Date.

Enter Origin Code.

Expand the Copy From Source Document section.

Select "Purchase Order Only" from the Copy From dropdown.

Click Go.

Enter the Business Unit of the agency that created the PO in the PO Business Unit field.

Enter the Purchase Order number in the PO Number From field

Click Search.

The available PO Lines display.

Click Select checkbox to the left of each PO line that should be copied into the voucher.

Review the UOM field on the Main Information tab to determine if the purchase order is distributed by Amount or Quantity (e.g., HR, EA, or QTY).

If the UOM is "AMT" - update the Merchandise Amount field with the invoice total.

When the purchase order is amount-based, do not change the Quantity field on the Invoice Information page (leave the default of "1").

When encumbered by amount, the voucher will match by price, thus the remaining dollar amount will be available to voucher.

The tolerance level for how much can be referenced on a PO vs. the remaining dollar amount available is defined at the Item ID level or Business Unit level. The general standard is a 10%tolerance.

If the UOM is Quantity (e.g., HR, EA, or QTY) - update the Quantity Vouchered field to reflect the quantity on the supplier invoice.

When the purchase order is quantity-based, do not change the Unit Price field .

APO setup by quantity will be liquidated by quantity; therefore, the quantities being vouchered must be calculated.

If the lines on the PO matched to the voucher are by quantity, a debit line cannot be added to the voucher by amount (it must also be quantity).

Click Copy Selected Lines.

The invoice and distribution line details on the Invoice Information tab update based on the PO line(s) selected.

Add Comments (optional) in the Header.

Add Attachments (optional) in the header.

Click the Payments tab.

The Payments page displays.

Under Payment Options, select the Hold Payment checkbox.

Select a Hold Reason from the dropdown menu.

Click Save.

Note the assigned Voucher ID.

Reopen the original email requesting OBM State Accounting to process a Reversal Voucher.

Reply to email stating Corrective VoucherCorrective Voucher is completed and assigned Voucher ID (provide number) is on the Hold Payment.

OBM State Accounting will process both the Corrective Voucher on Hold and the Reverse Voucher together to zero balance due and prevent check processing.